About Us

As a full-service commercial finance company, we are passionate about facilitating your business’s future success. Our consultative approach to lending combines tenured insights with small business flexibility to create winning solutions.

We strive to consistently strengthen our partner relationships by providing value-adding services throughout the financing process. Our philosophy is a testament to our professional’s ethical standards and the enduring relationships they’ve forged with them.

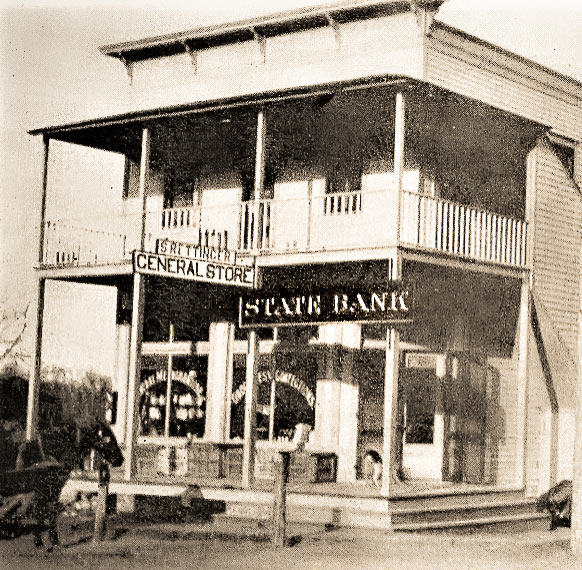

Rapid Capital office building in 1905 | Long Lake, Minnesota

Our History

The leasing and financing landscape looked drastically different in 1988 when Rapid Capital’s Founder, John Turnham first began his career. Accessible bank capital afforded borrowers reasonable rates, but the approval process was cumbersome. Immediately, John made a name for himself by championing client-oriented improvements at larger lending institutions. Then, in 2002 amidst a rapidly changing economy, he sought to create the ultimate financing experience and formed Rapid Capital.

John remains committed to keeping the client service experience at the core of Rapid Capital’s business strategy. Today, Rapid Capital seeks to expand its services by procuring broker, vendor, and lender partners who value the profit of putting people first.

Our team is comprised of professional problem solvers.

Why we’re different

Most financial institutions are constrained by lending guidelines that cater to only select niches of prospective borrowers. Rapid Capital works with a multitude traditional and non-traditional capital sources to propose financing options specific to your business's needs.

Our flexibility is unmatched. Our consultation is free. Your success is our only priority.

Resourceful

It’s not often you find a company as interconnected to other industry players and related service providers. Our network of professional consultants empowers us to provide you with the most informed and proactive financing solutions.

Creative

Are you convinced additional financing activities are out of the question given your circumstance? It could be that you just need to refinance existing assets. Ensure you’re business has what it takes to compete and ask us how we can creatively restructure your financial obligations.